Abstract

The rise of AI agents and hyper-automation is fundamentally reshaping how organizations surface, analyze, and act on risk. With nearly half of AI-assisted tasks now fully automated and enterprise adoption accelerating, risk intelligence can no longer rely on manual workflows or siloed data. RiskWise is built for this shift. By combining high-recall retrieval pipelines, proprietary LLM-driven agents, and dynamic risk indices, RiskWise transforms vast, heterogeneous datasets into structured, actionable risk insights. From uncovering hidden risk drivers to modeling cross-industry causal chains, RiskWise enables organizations to move beyond reactive monitoring toward proactive, agent-driven risk discovery. This post explores how RiskWise delivers scalable, future-ready intelligence for decision-makers navigating the era of hyper-automation.

Publish Date

August 22, 2025

Authors

“At the last dim horizon, we search among ghostly errors of observations for landmarks that are scarcely more substantial. The search will continue.”

– Edwin Hubble on observing faint, distant galaxies

Risk in the Era of Hyper-Automation

In February 2025, Anthropic published its Economic Index [1], constructed from millions of anonymized Claude conversations, which uncovered that 36% of occupations now use AI to perform at least 25% of their tasks. Of these AI-assisted tasks, 43% are fully automated and 57% are used to augment human work. Simultaneously, large language model (LLM) agents are demonstrating increasingly scalable intelligence, unlocking automation in previously manual workflows and raising efficiency even where a human-in-the-loop remains necessary. Gartner projects that by 2027, 50% of business decisions will be augmented or automated by AI agents [2], indicating a significant shift toward hyper‑automation.

This upcoming era will fundamentally transform how organizations’ surface, analyze, research, and predict risk. Consider the insurance industry: according to Boston Consulting Group [3], AI can boost efficiency in complex underwriting by up to 36% and improve loss ratios by 3 percentage points by grounding analytics in new and previously inaccessible data. This further highlights the business and competitive advantage of deploying advanced AI systems.

This is why we built RiskWise. RiskWise is a next-generation risk intelligence platform designed to scale and automate risk analytics and research. RiskWise continually ingests heterogeneous data, ranging from news and social media to legal filings and academic research. RiskWise’s AI systems surface latent risk signals by leveraging proprietary LLMs, high‑recall high-precision search pipelines, and agentic workflows. Built on top of our AI systems is a set proprietary time series & econometrics algorithms that construct risk indices that encode perceived and factual risk. Risk indices can be used to compare any company, product, industry or risk to improve data-driven decision making.

RiskWise AI: The Risk Intelligence Platform

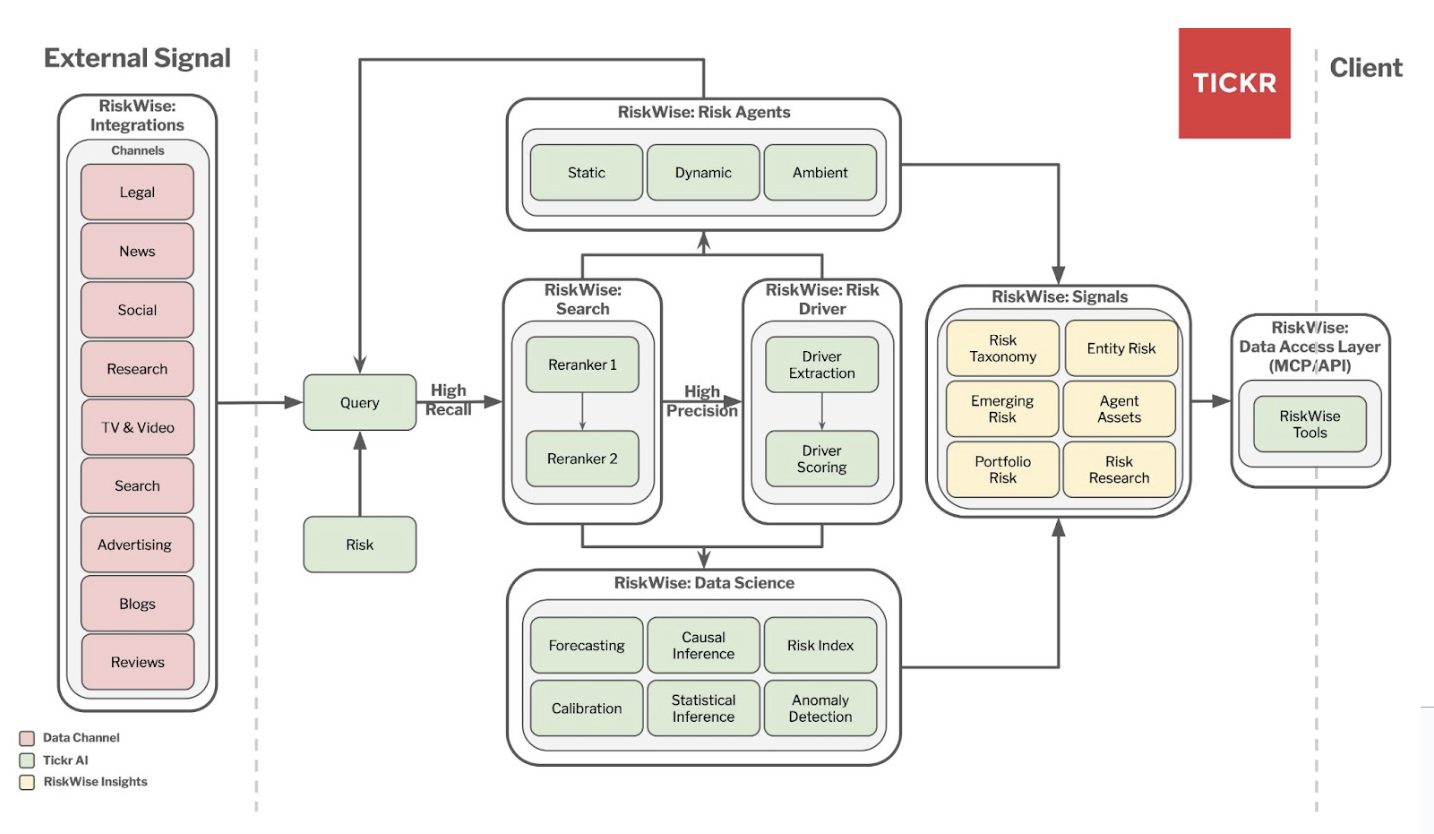

Figure 1: The RiskWise Risk Intelligence Platform

RiskWise AI brings together multi-channel data ingestion, AI search systems, and agentic workflows, and data science to deliver new and proactive risk discovery. Below, we discuss how each feature works together to power our risk intelligence platform (Figure 1)

Hybrid Retrieval Augmented Risk Analytics

When AI interacts with data, its accuracy is bound by the quality of that underlying data [4]. RiskWise addresses this fundamental issue with our proprietary multi-stage AI search pipeline designed for a high signal-to-noise. First, we execute a high-recall search conditioned on a specific risk to retrieve a candidate set of relevant documents from heterogeneous data sources. Historically, inefficient human-in-the-loop workflows have been required to preview results to ensure search breadth does not compromise downstream results, and that initial queries are not overly broad, resulting in significant downstream reranking costs. This is why we developed our Query Builder Agent, which systematically evaluates queries across different data sources, validating coverage prior to any downstream costly reranking. We then deploy a series of efficient proprietary reranking LLMs to return only documents that are relevant. Our hybrid retrieval pipeline ensures that all subsequent risk analytics and research are grounded in verified, high-quality information.

Risk‑Driver Discovery

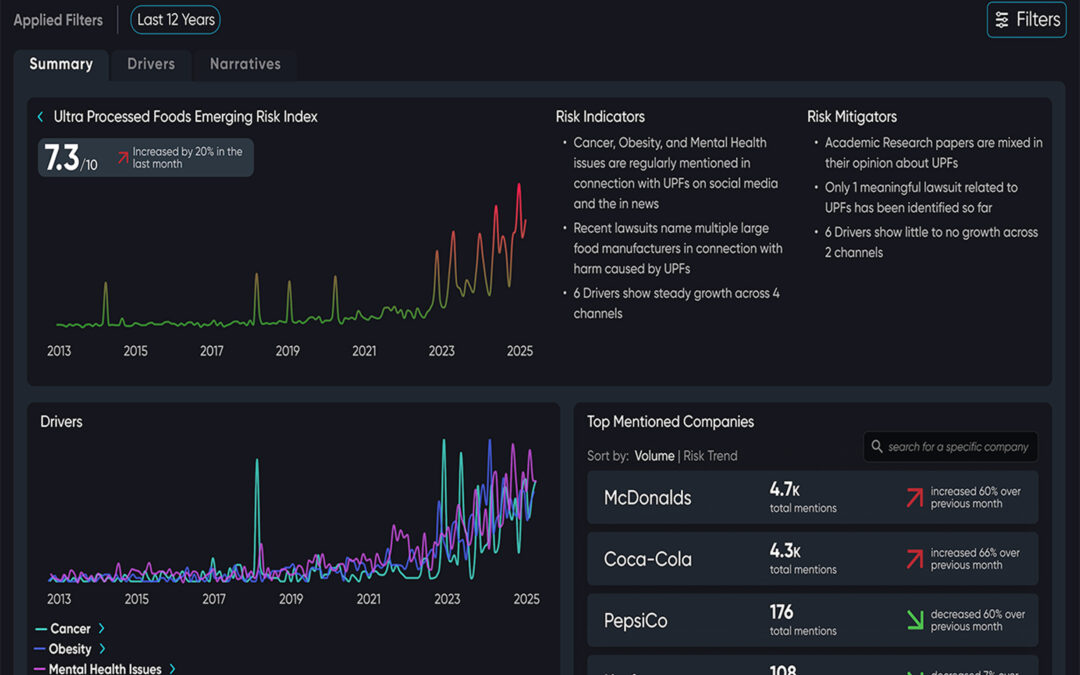

RiskWise AI’s Driver Discovery Agent finds & extracts risk drivers, the factors that create or amplify risk, giving organizations clarity about why a particular issue poses a threat. For instance, ultra-processed foods (UPFs) present significant concerns to both insurers and consumer packaged goods companies, but what specifically makes UPFs risky?

It’s the underlying drivers: links to cancer, increased cardiovascular disease, diabetes, and mental health disorders. These drivers lead to tangible negative events such as financial liability, regulatory scrutiny, and harm to reputation. RiskWise systematically monitors heterogeneous data channels, from scientific research and regulatory filings to news and social media, to surface and quantify these risk drivers. This enables our clients to understand, predict, and proactively mitigate emerging threats before they become costly.

Flexible Risk Definitions

Our clients work across diverse industries, from consumer packaged goods (CPG) to insurance, and each of these industries measure risk differently. For example, insurers typically minimize total claim payouts; CPGs concentrate on detecting emerging risks, preventing product recalls & competitive incursions; and consumer tech brands are concerned about their brand and product reputation. RiskWise is designed to model varying definitions of risk, whether it’s litigation, regulatory actions, financial losses, or other negative business outcomes.

Risk Indices

Each risk, risk driver, company, and product is quantified using indices that capture emerging risk. These risk scores reflect changing perceived and actual risk, giving executives a real-time understanding of risk exposure. The risk indices are calibrated so that a higher score indicates more risk, and they remain comparable across topics. Indices can be grouped, filtered, and used as inputs to other machine learning models.

Risk indices can be tied to outcome variables such as litigation, product recalls, and other events to directly measure a client’s definition of risk, not just the perceived and factual risk captured by our risk drivers.

Designed for the Era of Agents

RiskWise is engineered for an autonomous, agent-driven future, built with two open standards that ensure seamless, secure, and future-proof multi-agent workflows:

- Agent Access: RiskWise publishes its risk signals, drivers, and analytics through Model Context Protocol (MCP) servers [5]. This standardized interface lets MCP‑compatible agents securely access and interact with our data in real time to solve their own risk tasks.

- Agent Coordination: Once an agent accesses data via MCP, it can collaborate with other agents using the Agent‑to‑Agent (A2A) protocol [6]. This lets agents discover each other, use each other as tools, delegate tasks, and orchestrate workflows autonomously and securely.

We anticipate RiskWise itself will become an industry-standard agent tool used in all autonomous & augmentive risk workflows. This makes RiskWise both highly interoperable and future-ready.

Risk Agents

RiskWise includes a suite of proprietary, specialized agents built on our internally curated risk research dataset and evaluation framework. Based on the Deep Research Bench evaluation pipeline [7], including the RACE and FACT metrics, our risk agents achieve state-of-the-art performance.

Our static and dynamic risk agents and workflows are listed below:

- Query Agent: Tests search queries across heterogeneous data sources to ensure our downstream risk analytics are grounded on the most accurate data. The first workflow in risk search.

- Risk Driver Extraction Agent: Extracts the underlying drivers of perceived risk that could lead to negative events, through a series of iterative refinement LLMs and reasoning steps

- Risk Driver Deep Dive Agent: Conducts deep research into new or evolving risks, resulting in structured, cited, and industry-standard actionable reports.

- Narrative Development, Timeline, and Emerging Trends Agent: Constructs detailed chronological narratives linking risk drivers to observable events, enabling organizations to reconstruct causal chains.

- Risk & Mitigations Deep Summarizer: Provides executive summary views of risk exposure and mitigation progress via dashboards, integrating evolving risk indices with recommended actions.

- Risk Deep Research Agent: Enables users to explore emerging risks through an interactive research assistant that ingests natural language queries and shares responses with citations to external data integrations and RiskWise. The superposition of our agent stack in a chat interface through tool-use.

The Emergent Structure of Risk

Traditional risk assessment looks at threats in isolation, such that a product recall does not interact with future litigation. But what we are finding with our pipeline is that risk has an underlying structure that is emergent.

By modeling everything from PFAS contamination to generative AI misuse, from ultra-processed foods to harms to brand reputation, we uncover patterns that are invisible when looking at any single risk type. This emergent structure of risk reveals how risks interact, amplify each other, and move across data sources, risk drivers, industries to eventually lead to negative outcomes.

Why does this matter? Some risk use cases:

- Social media concerns about endocrine disruptors cause increased funding in peer-reviewed research, which then triggers litigation years later.

- Brand sentiment shifts on design forums precede the mass migration from Adobe to Canva, first visible in Google Search Trends before manifesting in quarterly earnings.

- The release of GPT-2 generates academic papers on AI training datasets, becoming cited evidence in copyright litigation against OpenAI years in the future.

These causal chains and interactions were always there, we can now surface and understand them with RiskWise AI.

Citations

[1] https://arxiv.org/abs/2503.04761

[2] https://www.gartner.com/en/documents/6212687

[4] https://arxiv.org/abs/2501.18365

[5] https://www.anthropic.com/news/model-context-protocol

[6] https://developers.googleblog.com/en/a2a-a-new-era-of-agent-interoperability/

[7] https://arxiv.org/abs/2506.11763