Abstract

Shopper Journey Data provides insights into why shoppers choose to purchase certain products at specific Retailers over others. Analyzing timestamps and basket-level purchases from the Ohio region, allows us to observe whether shoppers make subsequent trips for specific products on the same day. Our findings illustrate that walk-out rates vary by retailer, food category, and brand. Convenience and dollar stores have higher walk-out rates compared to grocery stores, likely due to their smaller size and limited assortments. Certain food categories have greater variation in walk-out rates across retailers, indicating that certain retailers are better at capturing the appropriate product assortment or provide more appealing pricing and promotions.

Publish Date

August 8th, 2024

Authors

Michael Gou

Introduction

Brief Description of Shopper Journey Data

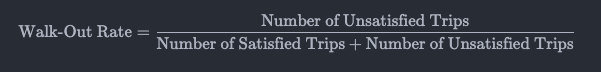

Constructing walk-out rates

As previously mentioned, data on shoppers’ trip circuit helps us understand how many trips were made, Retailers visited, and products purchased by a shopper within a given time period. To construct walk-out rates, we use these data and exploit the timestamps of shopping trips to characterize shopping trips as either satisfactory or unsatisfactory. The main assumption is that an unsatisfactory trip occurs when a shopper makes an additional trip on the same day, indicating they did not obtain all their necessary items on their first trip. For each household, on any given day we can observe:

- Number of shopping trips

- Precise timing of shopping trips

- Detailed basket of products purchased for each shopping trip

- Satisfied shopping trip at Retailer “k”: Household purchased products at Retailer k and did not have subsequent shopping trips on the same day.

- Unsatisfied shopping trip (i.e., walk out) at Retailer “k”: Household purchased brand “i” at a different Retailer “j” given previous trip was at Retailer “k” earlier the same day.

- Potential reasons for not making a purchase at Retailer “k”: product unavailability, price, package size, Retailer experience, unexpected circumstances, and etc.

Insights

| Retailers | Walk-out rates |

|---|---|

| Grocery A | 24.0% |

| Big Box A | 26.8% |

| Big Box B | 24.5% |

| Dollar A | 28.8% |

| All Retailers* | 25.8% |

Table 2: Walk-out rates across categories

| Retailers | Candy | Drinks | Bread |

|---|---|---|---|

| Grocery A | 2.6% | 3.4% | 2.1% |

| Big Box A | 3.3% | 4.3% | 2.1% |

| Big Box B | 3.0% | 3.4% | 2.3% |

| Dollar A | 4.1% | 4.8% | 2.1% |

| All Retailers* | 3.0% | 3.8% | 2.2% |

* Includes the Retailers mentioned above and all other Retailers operating in zip codes 453

Walk-out rates by category are inherently lower than walk-out rates by Retailer since we are focusing on subsequent trips resulting in purchases within the candy category (i.e., shopper had to purchase candy on their subsequent trip rather than any purchase). Walk-out rates do vary by category, which could be a reflection of how frequently shoppers purchase items for a category. Candy, Drinks, and Bread category purchases represent 3.0%, 4.7%, and 1.7% of all purchases in our dataset, respectively. However, lower variation in walk-out rates across Retailers for a specific category may suggest little variation in product assortment or price for that category. For example, if there is little variation in product assortment, package size, or price for the bread category across all Retailers then there is less of an incentive to make a second shopping trip to purchase packaged bread at a different Retailer. Lastly, there is variation in walk-out rates across Retailers within a category which suggests some Retailers are better at capturing the appropriate product assortment or providing more appealing pricing and promotions. Columns 3 and 4 provide results for the Drinks and Bread categories, respectively. The Drinks category appears to have more variation in walk-out rates across Retailer which could reflect their product assortment or prices.

Table 3 presents walk-out rates for specific brands. The brands shown reflect frequently purchases products in their respective categories mentioned in Table 2. Similar to the category walk-out rates constructed in Table 2, brand walk-out rates are inherently lower than walk-out rates by category and Retailer since we are focusing on subsequent trips resulting in purchases of a specific brand (i.e., a shopper had to buy Brand 1 on their subsequent trip rather than any product or category).

Table 3: Walk-out rates across brands

| Retailers | Brand 1 | Brand 2 | Brand 3 |

|---|---|---|---|

| Grocery A | 0.47% | 1.3% | 0.25% |

| Big Box A | 0.63% | 1.3% | 0.23% |

| Big Box B | 0.51% | 1.2% | 0.27% |

| Dollar A | 0.69% | 1.3% | 0.16% |

| All Retailers* | 0.55% | 1.3% | 0.24% |

* Includes the Retailers mentioned above and all other Retailers operating in zip codes 453

Walk-out rates do vary across brands, which may reflect how frequently shoppers purchase products within a category. Brand 1, 2, and 3 purchases represent 0.3%, 1.0%, and 0.2% of all purchases in the dataset, respectively. Additionally, these findings may also represent how well the brand is being placed in its product assortment or priced and promoted. Tables 1 through 3 provide valuable insights at the Retailer, category, and brand level, as variation across Retailers clarify how well Retailers and CPGs capture purchases through their product assortment and pricing strategies.

Conclusion

In this article we analyze shoppers’ trip patterns to construct walk-out rates and understand how shopper’s are choosing to make multiple shopping trips. At the Retailer level, the variation in walk-out rates suggests some retailers are more effective at capturing products and package sizes that households are more likely to purchase. Although certain Retailers, such as convenience and dollar stores, inherently have smaller store footprints and ultimately fewer products and package sizes, they can still optimize their product assortment to decrease their walk-out rates. We also observed that certain categories have higher variation in walk-out rates across retailers, which could be due to differences in product assortment and pricing and promotion strategies. At the brand-level, these same factors could also influence the variation in walk-out rates across retailers.

There are many possible explanations for these differences in walk-out rates. Future analysis could explore various different mechanisms such as directly comparing product assortments and prices/promotions between retailers. In addition, consumer-level analysis could provide insight on which households shop at certain stores for particular items or which households are inherently multiple-trip shoppers or one-store shoppers. In future work, we hope to incorporate consumer demographics and Retailer characteristics to better understand what influences walk-out rates and the potential actions Retailers and CPGs could take to lower their walk-out rates.

If you’re interested in learning more about how walk-out rates are created and the insights we can uncover, please feel free to reach out to us at info@tickr.com. We hope you found this article helpful and look forward to hearing from you!

Citations

[1] Numerator (2024). Numerator OmniPanel Data. Numerator https://www.numerator.com/omnipanels/